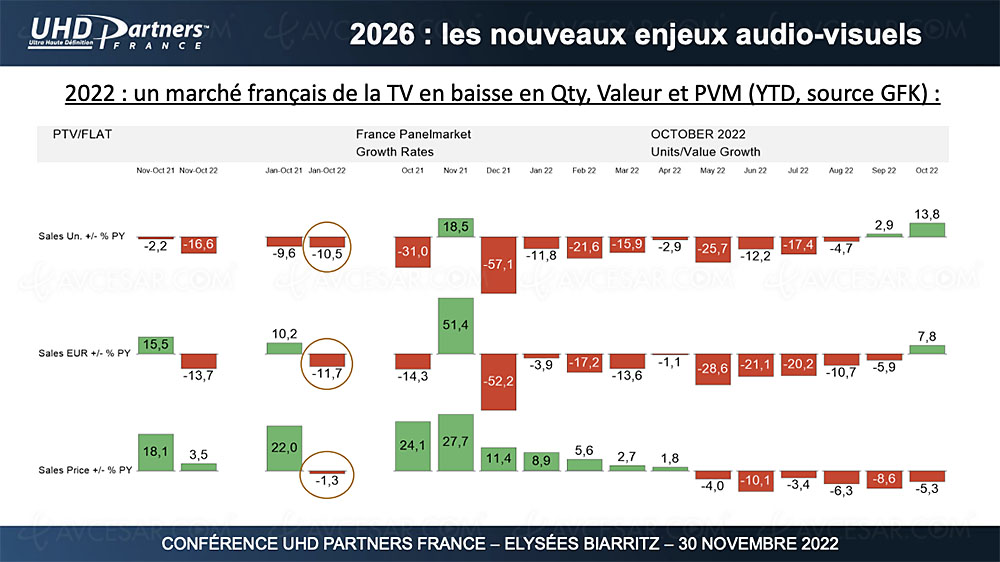

As the graph below shows, the French TV market in terms of sales (first line) is suffering. Even more so than the European market (second line).

Sales and turnover figures in Europe vs France

In detail, we see that these fell by -16.6% between November 1, 2021 and October 31, 2022 (after a drop of -2.2% for the same period 2020/2021), against a decline of -13.7% (and an increase of 15.5% for 2020/2021).

Nevertheless, we can see that the gap is closing for the first ten months of the year 2022 with a drop of -10.5% in France against -11.7% in Europe. These figures can be explained with the monthly data for the period October 2021 until October 2022. If the first half of the year is significantly worse in France than in Europe, it is the opposite from July. On the other hand, we note that this increase in sales is associated with a loss of turnover (third line of the graph).

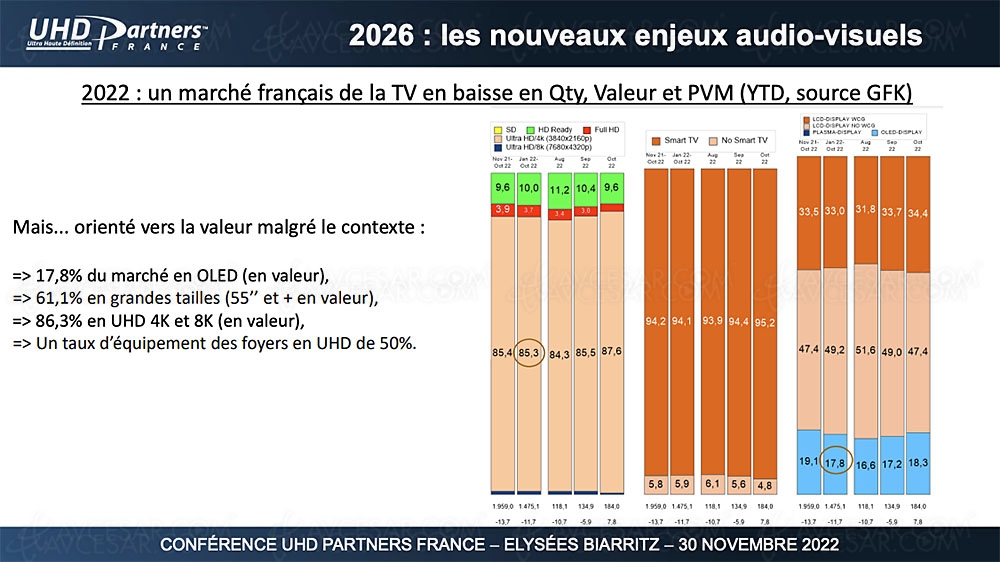

Zoom on the typology of the TV market in France

In the midst of the market slump, all is not bad. Hope remains when we study in detail the typology of sales. We then note that purchases are increasingly oriented towards the most expensive models. Thus, Oled TVs represent 17.8% of the market in value (see figure circled in the graph above), which is significantly more than its market share in volume. Similarly, still in value terms, 61.1% of revenue comes from so-called large television sets, ie 55'' (140 cm) and over. In value again, 86.3% of sales are generated by Ultra HD 4K/8K TVs (see circled figure on the graph above). To be precise, at the end of 2022, the rate of Ultra HD TV equipment in French homes will exceed 50%.