While video shelves are less and less present each year in stores, the turnover of the video market in France has never been so important. As you will have understood, for ten years there has been a phenomenon of communicating vessels between the streaming sector and that of physical video. Even if all is not rosy in the streaming market segment, where only the SVOD segment gives the change. Explanations.

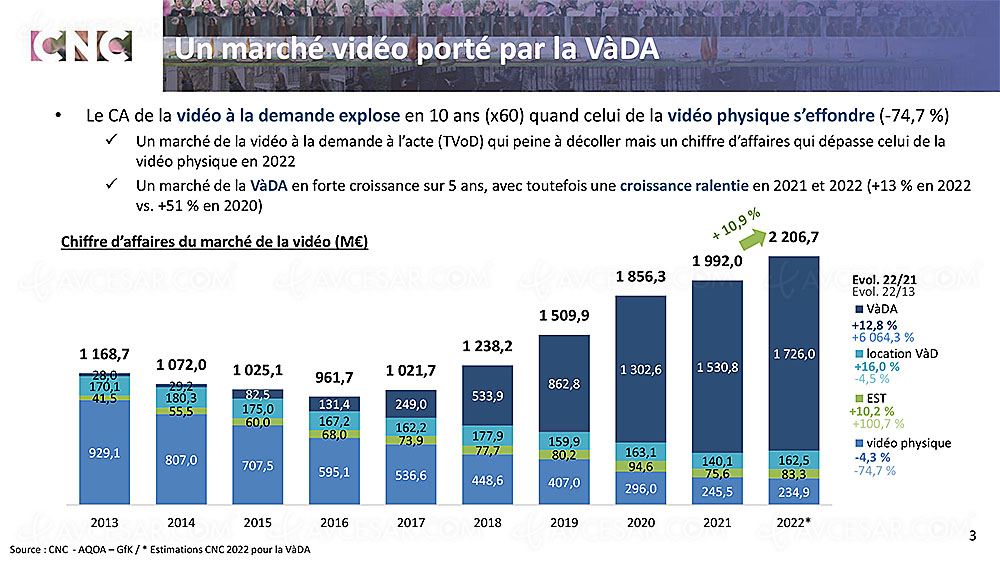

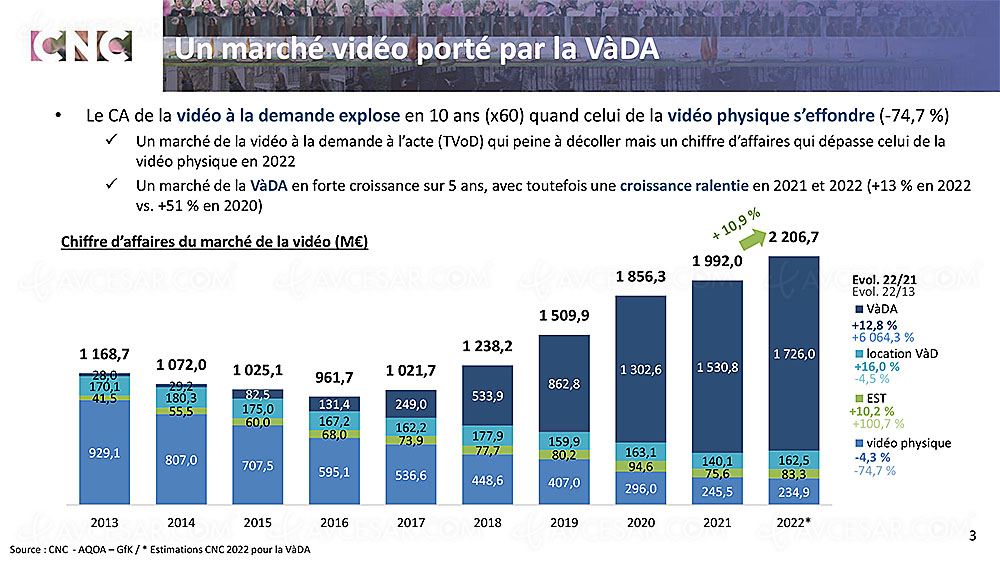

This is a first, the French video market has a turnover of more than 2 billion euros (just over 2,200 million, see graph below) while all the main publishers or almost, coming from the Hollywood majors, see their receipts and their profitability (therefore their capacity for investment and production) plummet.

French video market, streaming rules

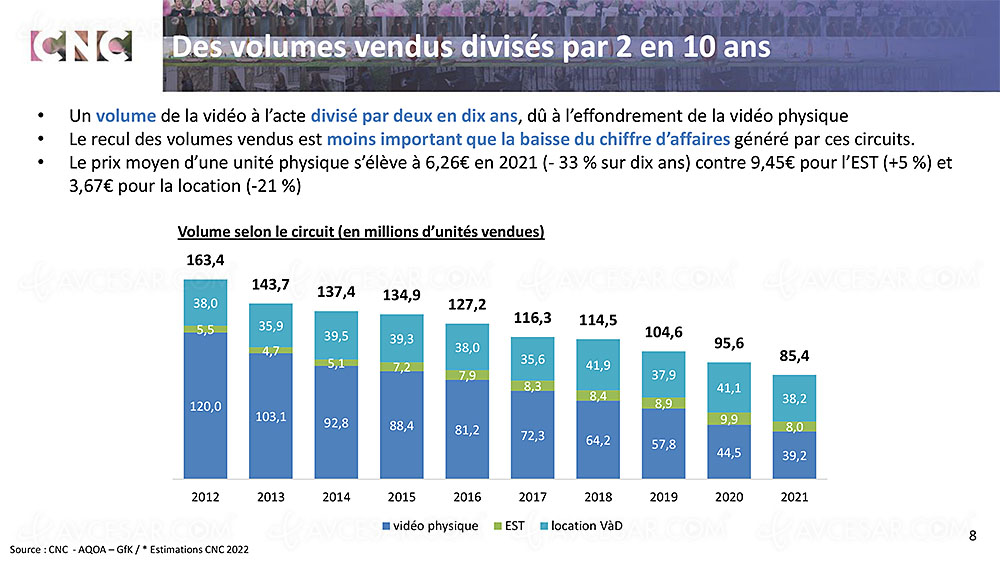

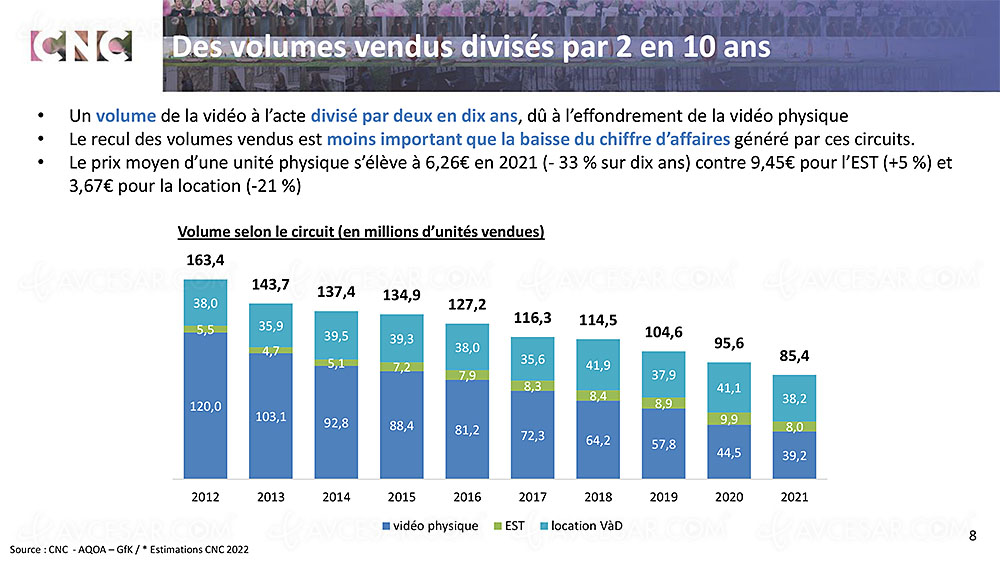

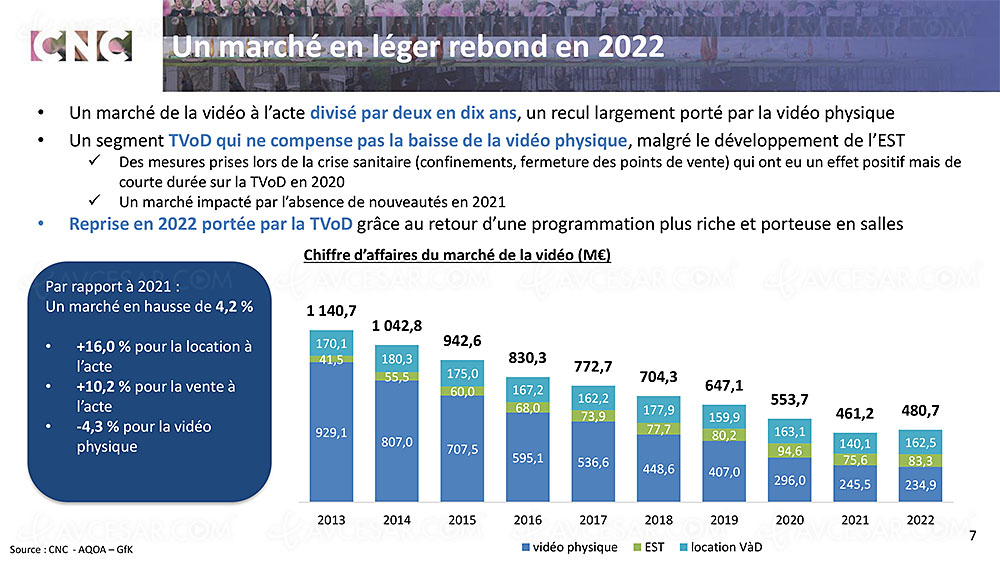

! Even if the last few months have brought a smile back to "traditional" video editors with the resounding theatrical successes of Top Gun: Maverick (click to discover our complete test of the 4K Ultra HD edition) or Avatar: the way of water (click to discover our film review), the latter are suffering mercilessly from the collapse of the physical video market in favor of the SVOD market initiated in 2007 in the United States (and which exploded in 2015 in France) , a market in which they are still dwarfs compared to Netflix and Amazon Prime Video. And if one of them, The Walt Disney Company, has decided to raise the iron with the launch of Disney + in 2019 in the USA and 2020 in France, it is at the cost of colossal investments and abysmal losses. The Disney group is undergoing a scissors effect with the collapse of revenue from discs on the one hand, considerable expenditure to impose itself on the streaming market, on the other. While the streaming sector imposes its law, the physical video sector is collapsing. Over the last decade, while the turnover of SVOD has multiplied by 60, that of physical video has collapsed by around 75%. In volume, it's a little better, but here again, the fall is steep with sales halved in ten years (see graph below).

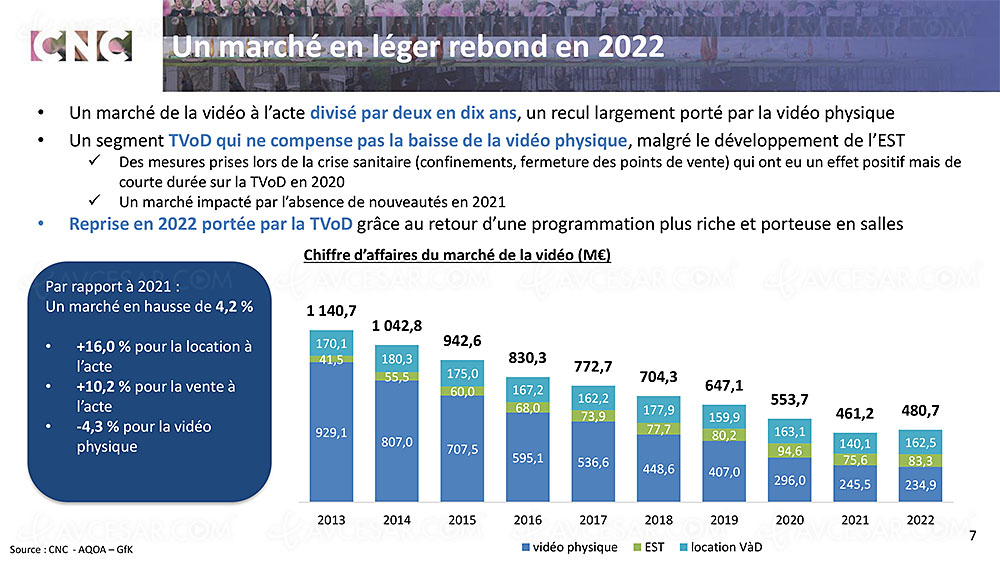

Another blow for the physical format, for the first time in 2022, the turnover of transactional VOD (either the definitive purchase or the rental of digital content, EST or TVOD), a poor relative of the video market since its inception, exceeds that of physical video, 245.8 million euros against 234.9 million (see graph below). This is to say the tumble of DVD and Blu-Ray/4K Ultra HD Blu-Ray.

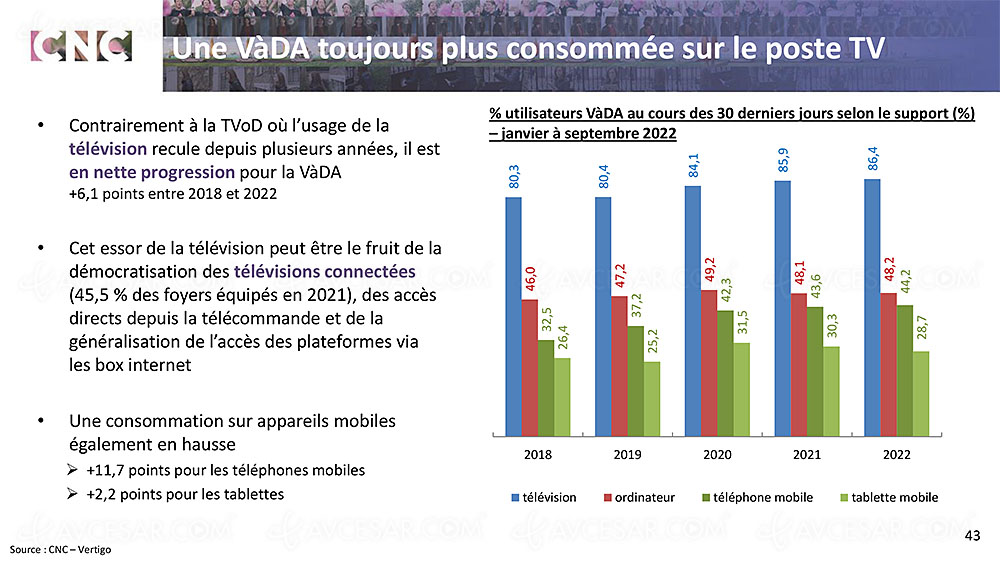

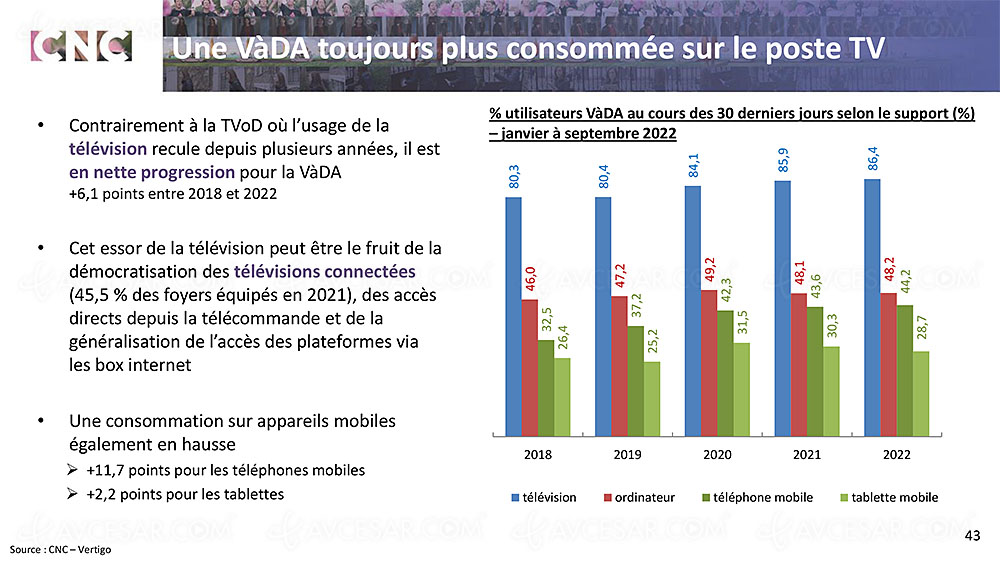

, France video market 2022, zoom on SVOD SVOD, like the health crisis, marks the return to grace of the television within the home. The massive arrival of Smart TVs (or connected TVs) in living rooms in recent years has considerably simplified access to the various streaming services. Thus, SVOD is increasingly consumed on televisions (+6.1% between 2018 and 2022), to the detriment of computers and tablets. Only the smartphone is seeing its use progress for SVOD subscribers (see graph below).

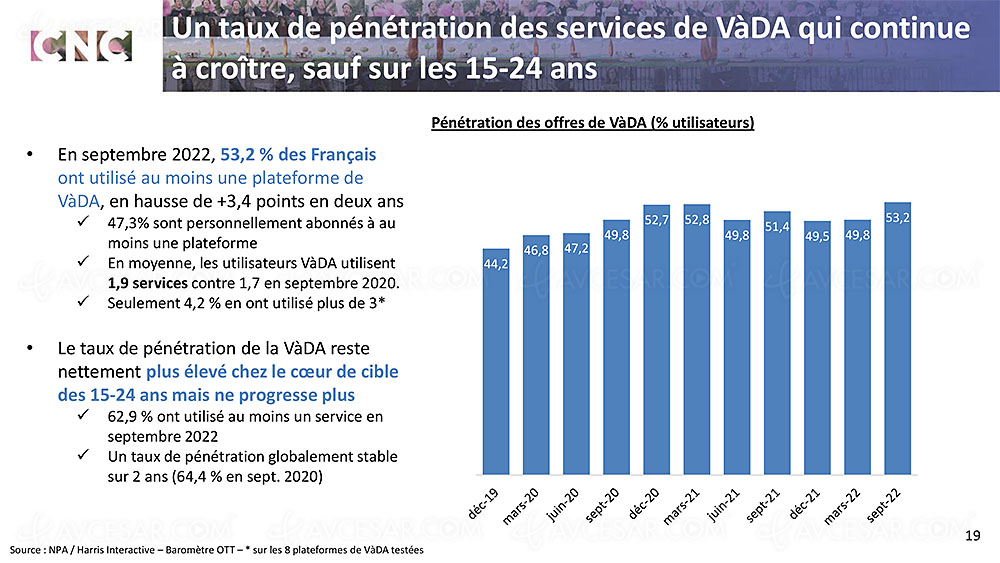

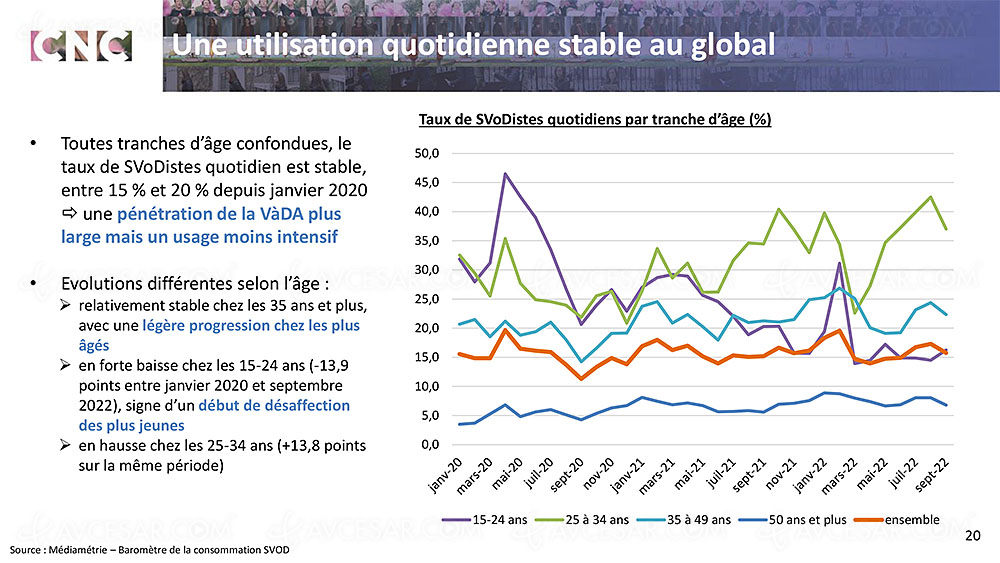

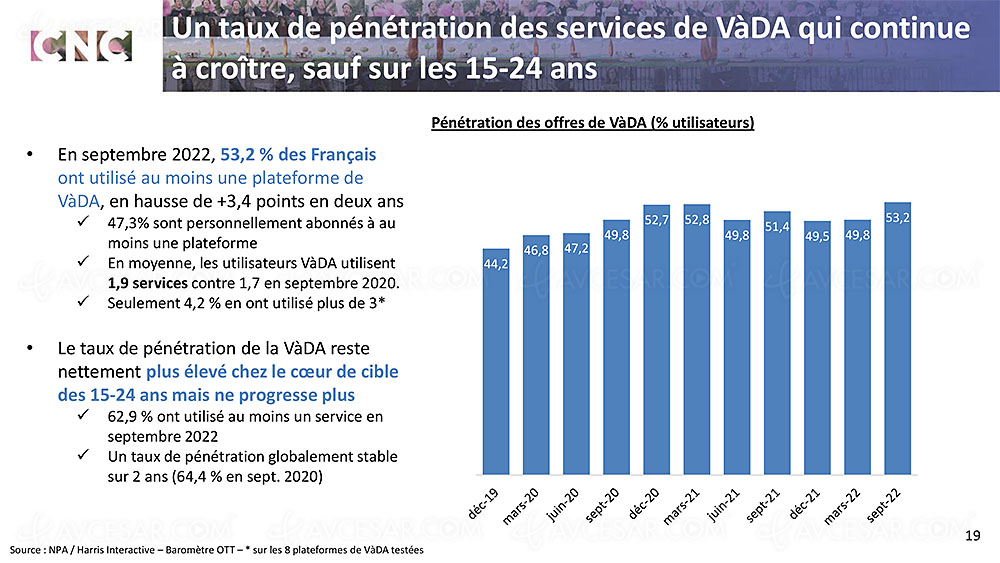

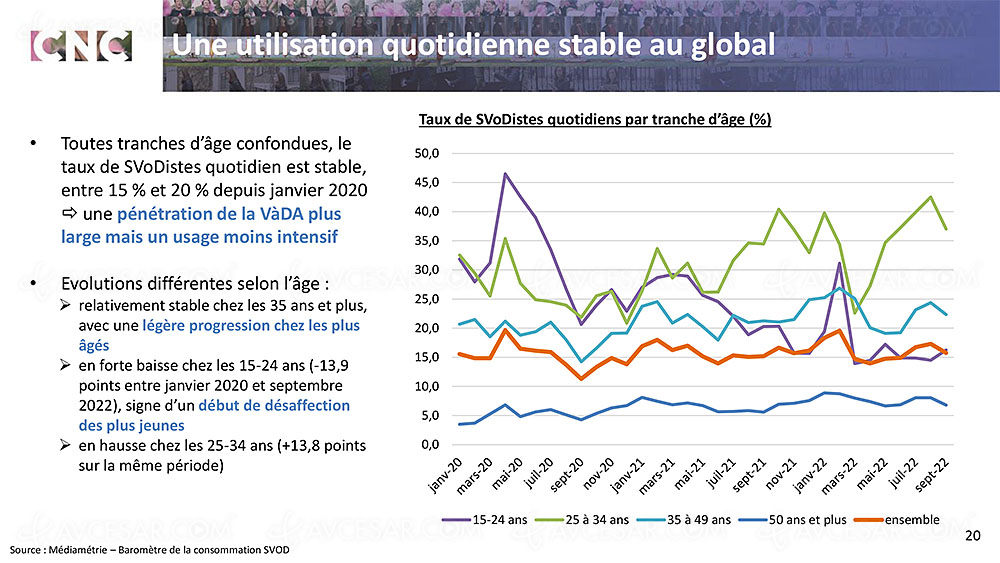

Similarly, the penetration of SVOD offers continues to grow, particularly among people over 24, while its use has been stable among those over 35 and down among those under 24, since 2020 ( see first graph below). In the end, the rate of users of a daily SVOD service has remained stable since January 2020 (see second graph below).

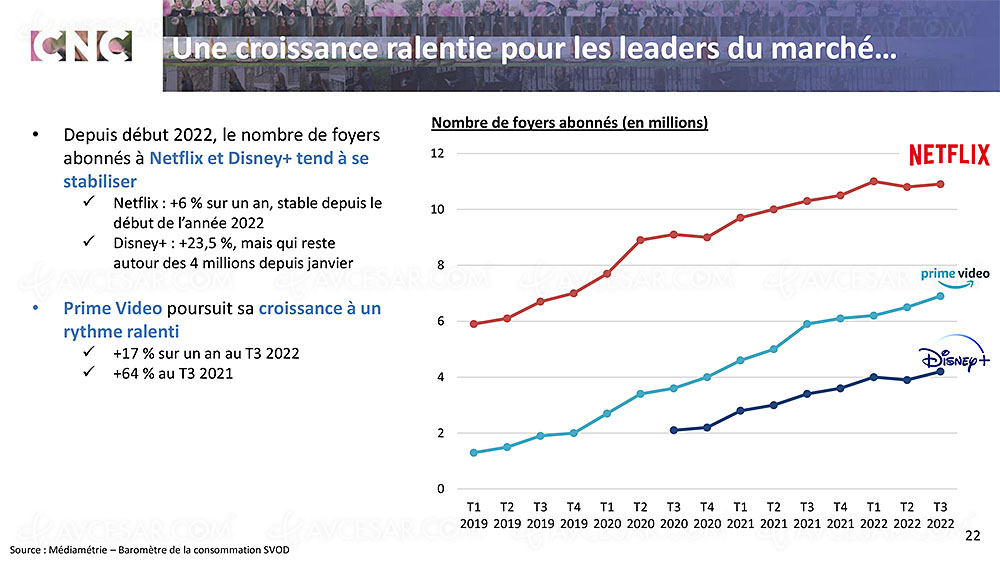

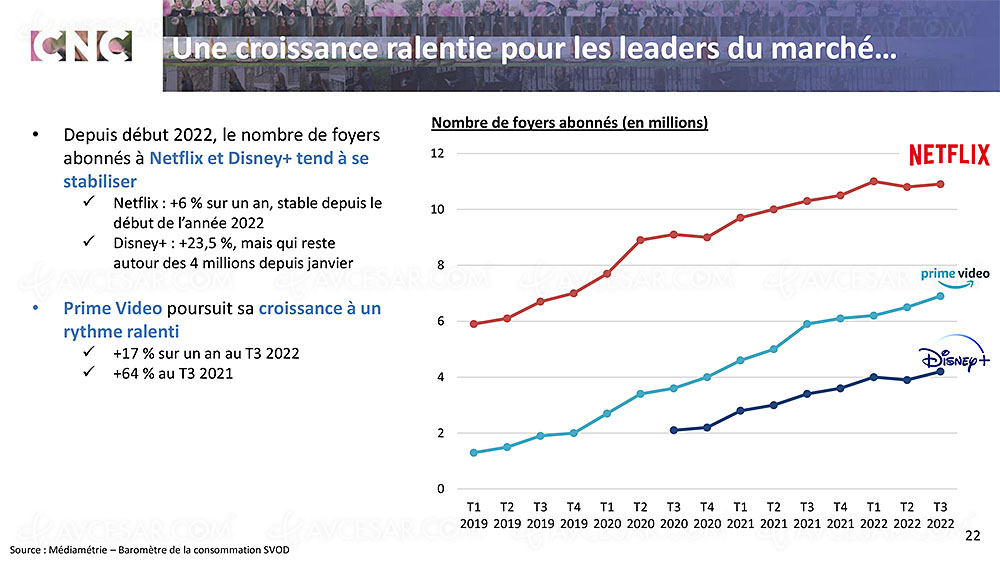

Top 3 video streaming market France 2022 These trends explain the slowdown in growth observed among the leaders on the SVOD market, Netflix, Amazon Prime Video and Disney+, which together have around 22 million subscribers in France: 11 million for Netflix, 7 million for Amazon Prime Video and 4 million for Disney+ (see graph below).

Top 3 video streaming market in the world 2022, Netflix arch-leader On a global scale, the podium of SVOD platforms remains roughly the same, with the exception of the huge US market which sees the Hulu service climb to second place behind Netflix and ahead of Amazon Prime Video. We should also point out the particular case of Sweden with the Viaplay and HBO Max offers behind Netflix (see graph below).

Another blow for the physical format, for the first time in 2022, the turnover of transactional VOD (either the definitive purchase or the rental of digital content, EST or TVOD), a poor relative of the video market since its inception, exceeds that of physical video, 245.8 million euros against 234.9 million (see graph below). This is to say the tumble of DVD and Blu-Ray/4K Ultra HD Blu-Ray.

Another blow for the physical format, for the first time in 2022, the turnover of transactional VOD (either the definitive purchase or the rental of digital content, EST or TVOD), a poor relative of the video market since its inception, exceeds that of physical video, 245.8 million euros against 234.9 million (see graph below). This is to say the tumble of DVD and Blu-Ray/4K Ultra HD Blu-Ray.  , France video market 2022, zoom on SVOD SVOD, like the health crisis, marks the return to grace of the television within the home. The massive arrival of Smart TVs (or connected TVs) in living rooms in recent years has considerably simplified access to the various streaming services. Thus, SVOD is increasingly consumed on televisions (+6.1% between 2018 and 2022), to the detriment of computers and tablets. Only the smartphone is seeing its use progress for SVOD subscribers (see graph below).

, France video market 2022, zoom on SVOD SVOD, like the health crisis, marks the return to grace of the television within the home. The massive arrival of Smart TVs (or connected TVs) in living rooms in recent years has considerably simplified access to the various streaming services. Thus, SVOD is increasingly consumed on televisions (+6.1% between 2018 and 2022), to the detriment of computers and tablets. Only the smartphone is seeing its use progress for SVOD subscribers (see graph below).  Similarly, the penetration of SVOD offers continues to grow, particularly among people over 24, while its use has been stable among those over 35 and down among those under 24, since 2020 ( see first graph below). In the end, the rate of users of a daily SVOD service has remained stable since January 2020 (see second graph below).

Similarly, the penetration of SVOD offers continues to grow, particularly among people over 24, while its use has been stable among those over 35 and down among those under 24, since 2020 ( see first graph below). In the end, the rate of users of a daily SVOD service has remained stable since January 2020 (see second graph below).

Top 3 video streaming market France 2022 These trends explain the slowdown in growth observed among the leaders on the SVOD market, Netflix, Amazon Prime Video and Disney+, which together have around 22 million subscribers in France: 11 million for Netflix, 7 million for Amazon Prime Video and 4 million for Disney+ (see graph below).

Top 3 video streaming market France 2022 These trends explain the slowdown in growth observed among the leaders on the SVOD market, Netflix, Amazon Prime Video and Disney+, which together have around 22 million subscribers in France: 11 million for Netflix, 7 million for Amazon Prime Video and 4 million for Disney+ (see graph below).  Top 3 video streaming market in the world 2022, Netflix arch-leader On a global scale, the podium of SVOD platforms remains roughly the same, with the exception of the huge US market which sees the Hulu service climb to second place behind Netflix and ahead of Amazon Prime Video. We should also point out the particular case of Sweden with the Viaplay and HBO Max offers behind Netflix (see graph below).

Top 3 video streaming market in the world 2022, Netflix arch-leader On a global scale, the podium of SVOD platforms remains roughly the same, with the exception of the huge US market which sees the Hulu service climb to second place behind Netflix and ahead of Amazon Prime Video. We should also point out the particular case of Sweden with the Viaplay and HBO Max offers behind Netflix (see graph below).