While all the figures for the 2023 TV market are in, the report released by DSCC indicates that the last quarter of last year saw minimal growth in premium TV shipments, +1% compared to the same period in 2022, to reach the figure of 6.9 million units.

Premium TV market 4th quarter 2023, volume and value figures££££

In volume, zooming in on the figures, we notice that this growth is attributed only to LCD TVs which show an increase of +10% and 5 million copies while Oled TVs show a significant drop of -17% and 1.9 million.

In value, the fourth quarter of 2023 turns out to be the eighth consecutive quarter of decline for the premium TV market with revenues declining -3% to $7.6 billion. Consistent with the volume figures for the period, the situation is contrasted depending on the nature of the broadcasters, -18% for Oled TVs at $2.8 billion and +9% for LCD screens at $4.8 billion. DSCC specifies that the growth in premium LCD TV sales and a more diversified offer have more than offset the price reductions observed in particular during Black Friday.

Premium TV market 4th quarter 2023, Samsung attacked but still leader ££££

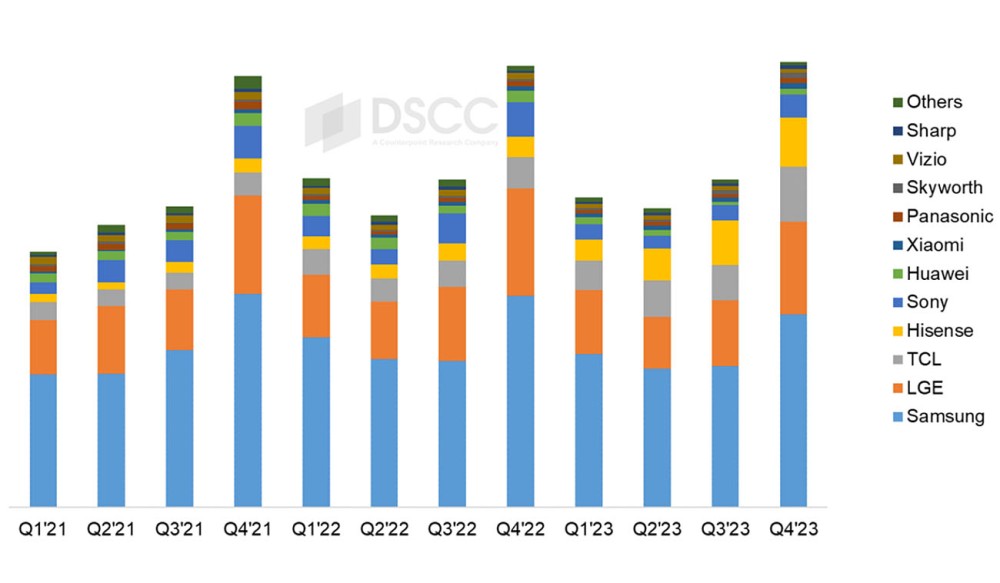

Competition between brands has evolved. If Samsung largely maintains its leadership position in volume and value despite a respective drop of -9% to 3 million units and -5% to represent 42% of revenues generated over these three months (compared to 45% on average over the year, see our news Premium TV market 2023: Top 5 from Samsung to Sony). Samsung's dominance in the Mini LED TV market segment is in fact contested by the Chinese brands Hisense and TCL.

Premium TV market 4th quarter 2023, LG suffers££££

LG also experiences a drop in its shipments, -14% while its turnover plummets by -22%, leading to a loss of share of market value of -5%. LG of course maintains a strong position in the Oled television market but the latter is collapsing at least -24% (see our news Oled TV market 2023, from decline to fall (-24%)), -29 % according to other analysis firms. And as LG has a minimal market share of the Mini LED TV market, only 3%, the Korean manufacturer is not celebrating.

Premium TV market 4th quarter 2023, emergence of Chinese brands££££

Contrary to Korean brands, the Chinese TCL and Hisense have made significant progress. In volume, TCL grew by +77% and Hisense by +135%. Thus TCL has overtaken Sony in value market share, and finds itself in third position with 11%, while Hisense secures its fourth position in volume and value. Coming back to Sony, the Japanese brand is the big loser in the last quarter of 2023 with a collapse in its shipments to -33% and its revenues to -35%. She fell to fifth place in both categories.