Chinese [abc]LCD[/abc] panel manufacturers, accounting for almost 100% of the world's LCD TV panel production, have collectively decided to reduce the operating rate of their production lines to around 60%/70%, a move that is expected to have significant repercussions on the global supply chain.

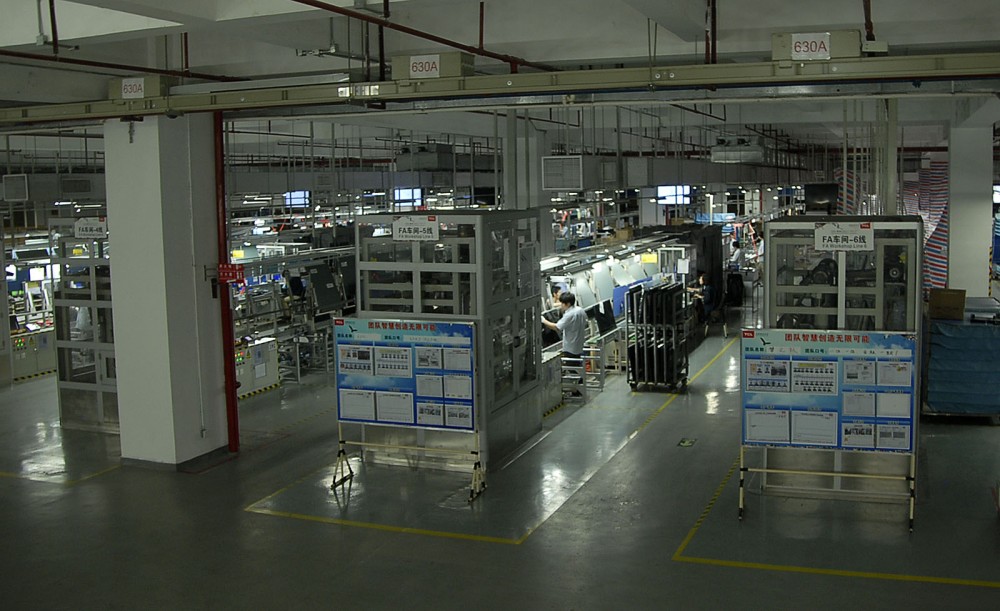

China 'steers' global LCD TV panel prices££££

Considering the appreciation of the selling price of LCD panels since January 1, 2024, this operating rate was 80%/90% last May. Billed at $122 in early January, the price of the 55" (140 cm) LCD TV panel, the most requested by brands, was then negotiated in May 2024 at $132. However, the drop in LCD screen prices observed since July, due to weak Chinese demand and a large proportion of low-end models in the United States degrading the profitability of brands, and therefore their purchasing capacity, is encouraging Chinese manufacturers to adjust their production strategies to maintain their sales prices.

An industry analyst commented: "Chinese companies are expected to reduce their factory operations for two to three weeks around the October 1 national holiday. While the proportion of [abc]Oled[/abc] screens remains high for mobile devices and tablets, the proportion of LCD screens for TVs has not decreased, which gives Chinese companies a de facto pricing power.