Display Daily's quarterly analysis of the TV manufacturing sector shows a significant rebound in TV shipments for the period from July 1 to September 30, 2024, +11% for 62 million units. This is the second consecutive positive quarter of increase.

TV market Q3 2024: shortened renewal cycle££££

To explain this situation, Display Daily gives the floor to the analysis and market research organization Counterpoint Research, which explains that consumers have started a faster-than-usual TV renewal cycle for one simple reason: consumers' growing appetite for larger screens.

TV Market Q3 2024: A Closer Look at Different Markets££££

Drilling down into the different markets, Couterpoint Research states: “While the recovery was seen globally, Eastern Europe led the charge with a 24% increase in shipments, followed by strong performances in North America and Western Europe. Japan, however, lagged behind other regions.”

TV Market Q3 2024: A Closer Look at Different Markets££££

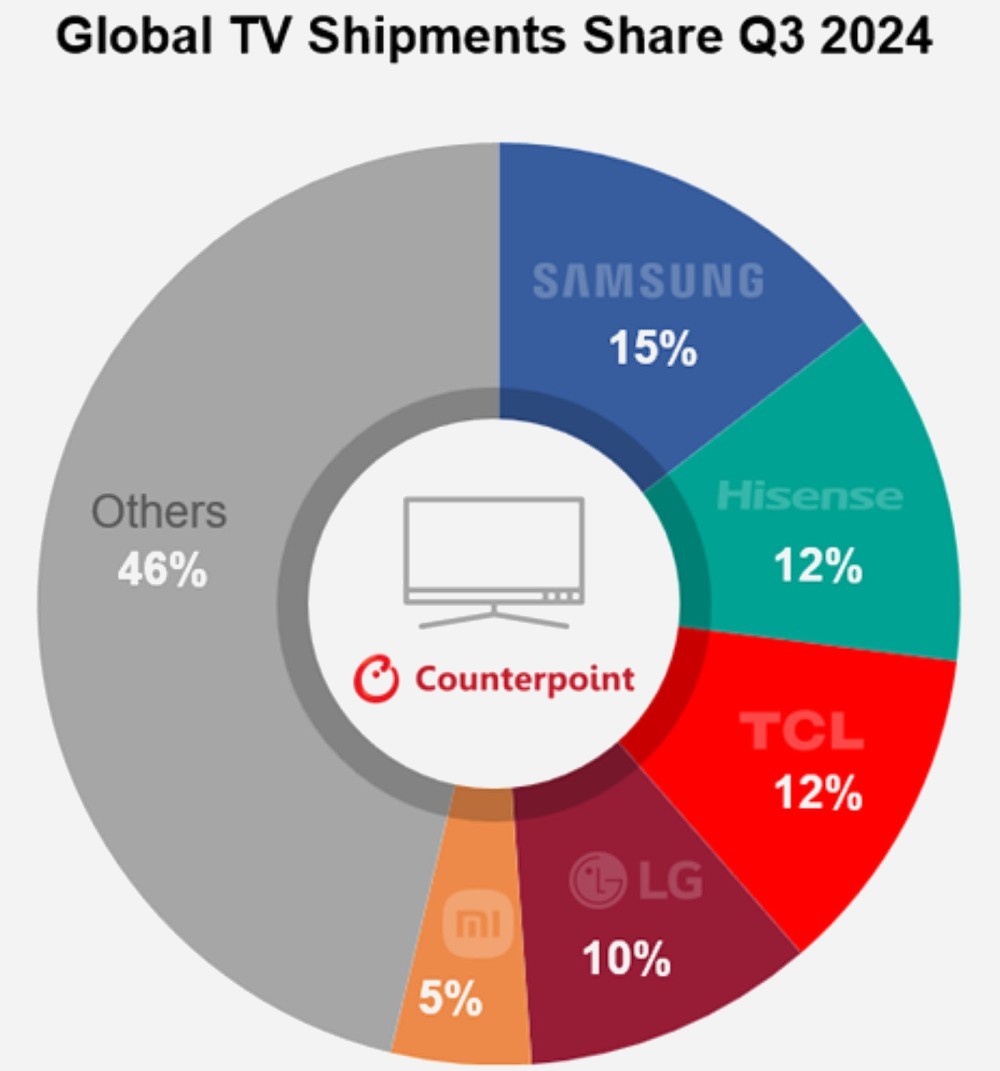

“Samsung maintained its position as the global market leader with a 15% market share. However, its dominance was slightly dented compared to the previous quarter. Chinese brands, including Hisense and TCL, are rapidly gaining ground. Hisense reclaimed second place, shipping 1% more TVs than in Q3 2023, while TCL moved into third place. LG, ranked fourth, saw a 7% increase year-on-year, driven by strong performance in Europe, bringing its market share back into the single digits" (see illustration above).

TV Market Q3 2024: Focus on Premium TV Segment££££

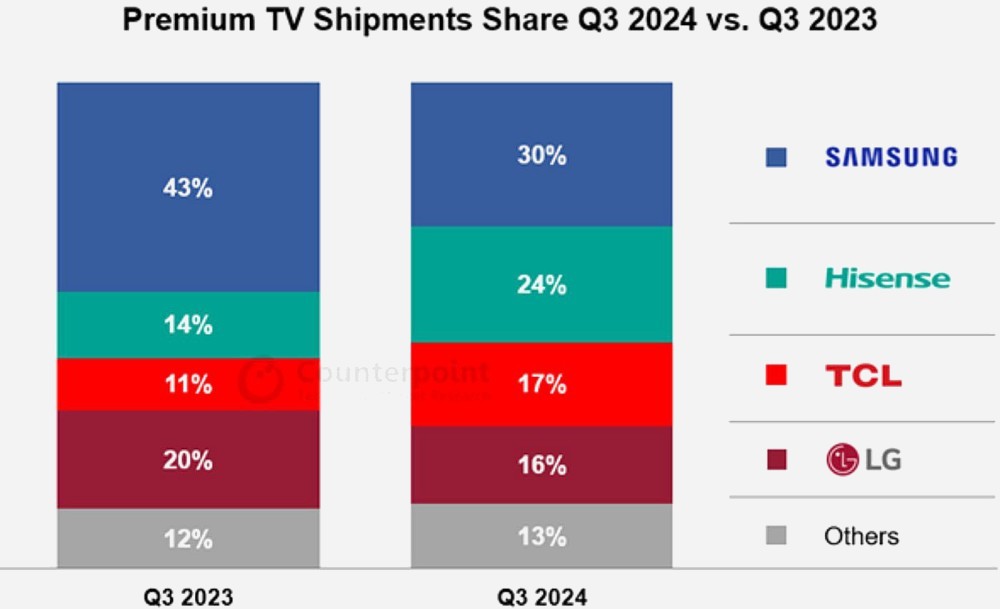

"The premium TV segment, which includes OLED, QLED and Mini LED models, surged 51% year-on-year to a record high. Mini LED TVs, in particular, saw remarkable growth of 102% year-on-year, outpacing OLED shipments for the first time. QLED TV shipments also grew by more than 50%, with quarterly shipments exceeding 4 million units. OLED TVs saw a more modest 13% year-on-year growth,” the report said (see illustration above).