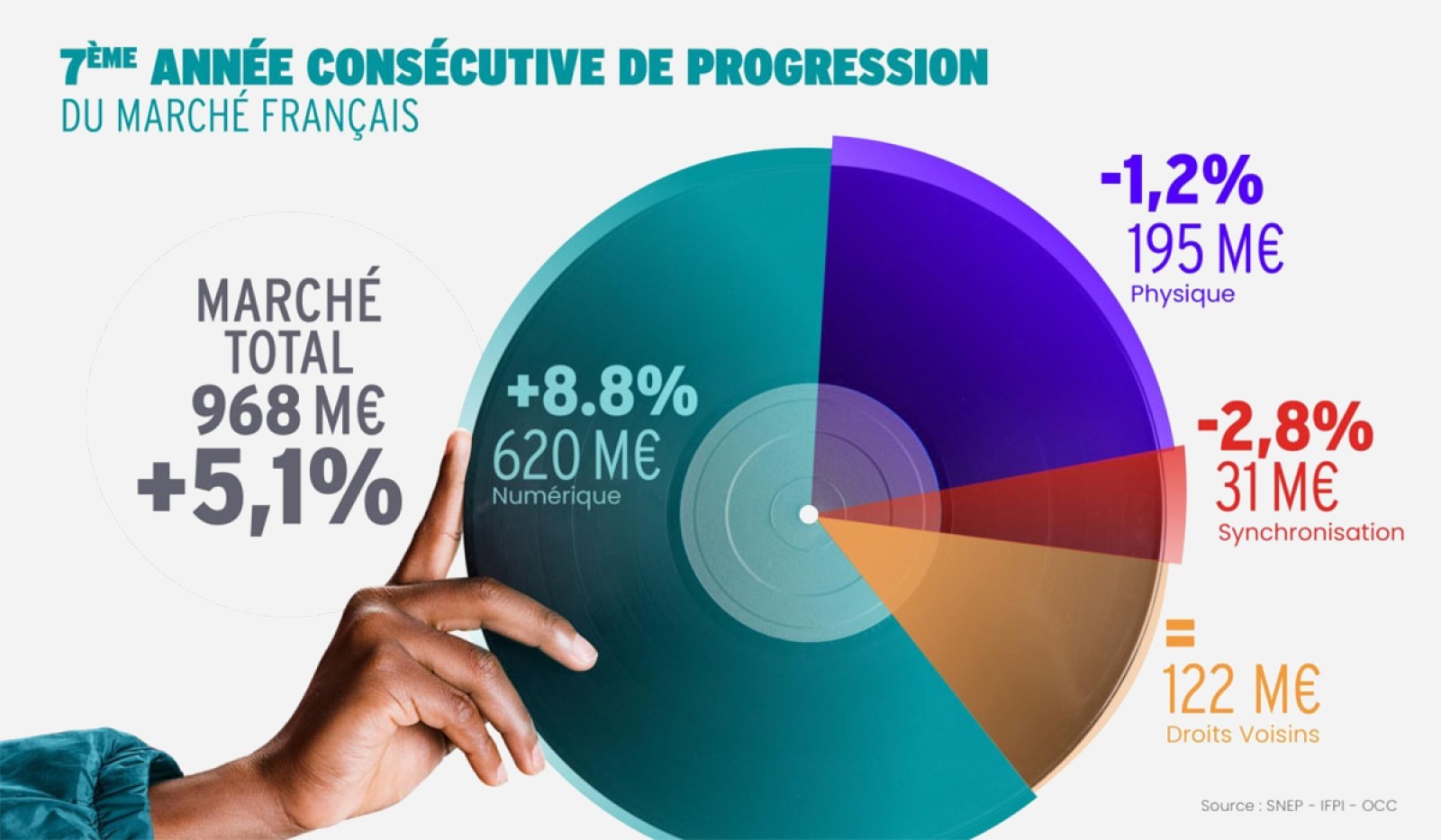

In 2023 (for 2024, the figures will not be known for several months), the music market is experiencing a new year of growth, the seventh in a row, with a total turnover of 968 million euros, an increase of +5.1% compared to last year.

French music market, zoom in on turnover££££

Logically, the digital share (streaming platform) shows an increase of 8.8% to 620 million euros while the share of the physical segment shows a decrease, -1.2% to 195 million euros. For their part, the Synchronization markets (use of music for example in a film, a series, a game, etc.) and Neighboring Rights (exploitation of works in a commercial location for example) show a decrease of 2.8% for 31 million and a balanced situation with 122 million in revenues respectively.

French music market, zoom in on turnover££££

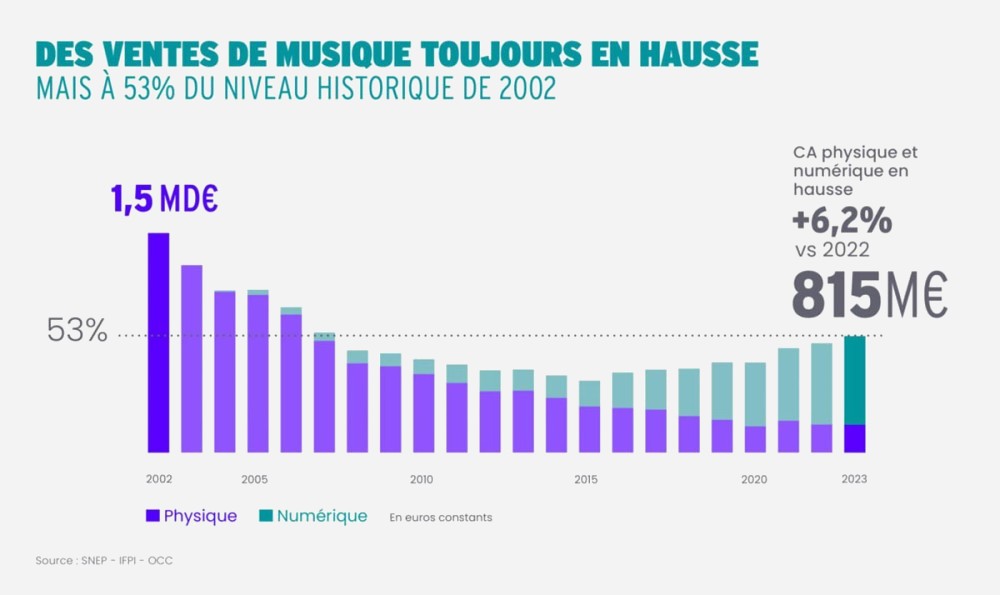

Overall, music sales in France are therefore still growing (815 million euros in 2022) but they remain far from their peak, known in 2002 at 1.5 billion euros. In the meantime, the industry has made a radical shift from physical media to the dematerialized world (see graph above).

French music market, zoom in on the physical and dematerialized segments££££

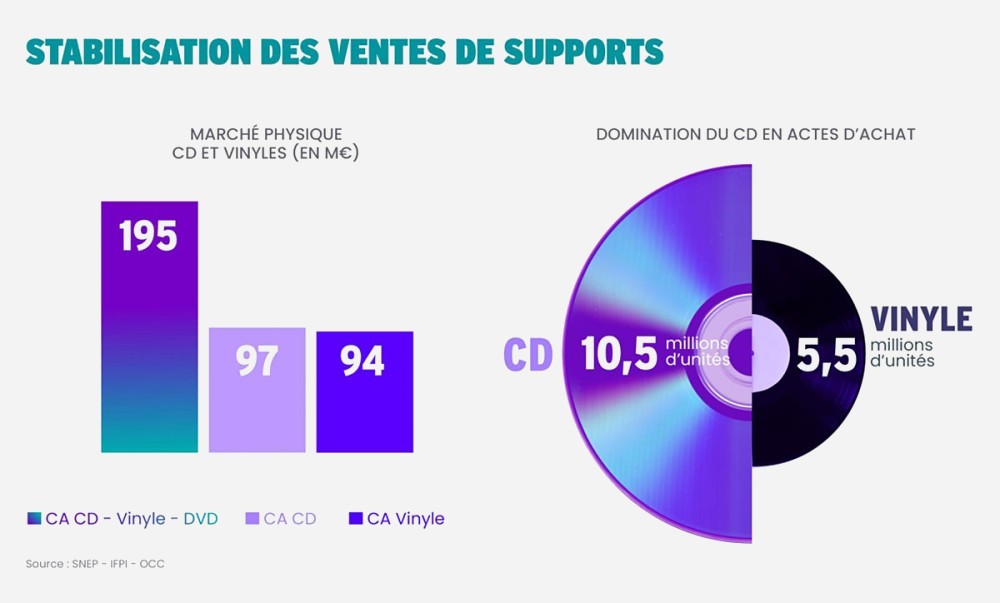

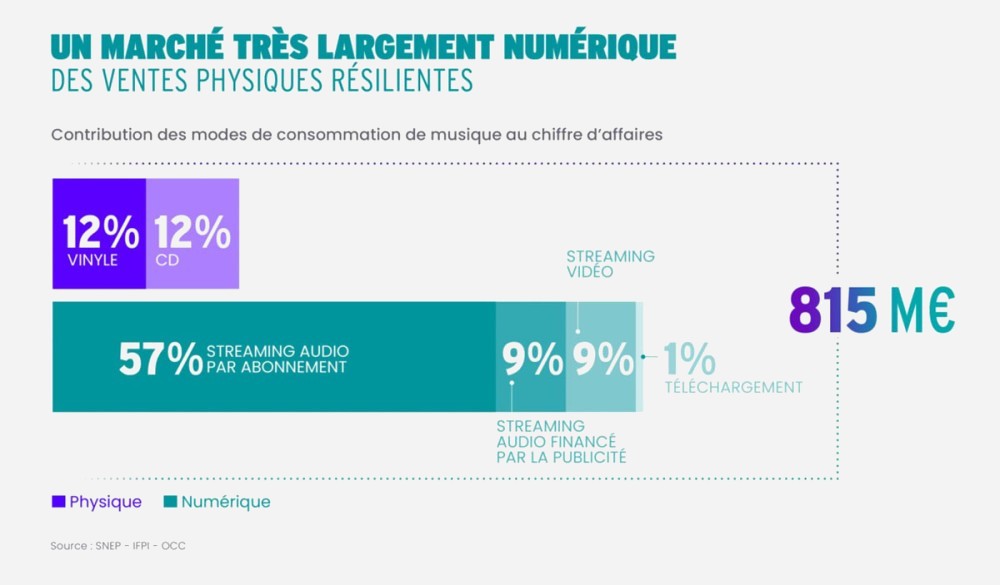

By zooming in on the turnover of music sales, we notice that the physical media Vinyl and [abc]Audio CD[/abc] each account for 12% of the value against 76% for streaming (see graphs above). The latter is broken down to 9% for streaming financed by advertising, 9% for video streaming, 1% for definitive downloading and 57% for streaming by subscription. To return to the sales of physical media, if the Vinyl and Audio CD segments are almost equivalent, it is another story in volume with approximately 2 CDs sold for 1 vinyl see graphs below).